Massive money printing has a devastating impact on Canadians, while benefitting those closest to the Bank of Canada.

Printing copious amounts of fiat currency is often promoted as a ‘progressive’ policy.

After all, progressives love to ‘spread the wealth,’ and printing money means more to go around for everyone, right?

Of course, we know that’s not how it works.

Printing a bunch of money ends up meaning there is more money chasing the same number of goods, which inevitably leads to higher prices.

There’s nothing ‘progressive’ about that, considering that those impacted the most by higher prices are those who have to spend a large proportion of their income on basic necessities.

By contrast, those who already have lots of money can more easily absorb the impact of higher prices.

But it goes beyond that.

Due to what is called the ‘Cantillon Effect,’ surging money printing benefits those closest to the Bank of Canada, while hurting nearly everyone else.

Here’s how it works, as explained in Bitcoin Magazine:

“The Cantillon Effect refers to the change in relative prices resulting from a change in money supply. The change in relative prices occurs because the change in money supply has a specific injection point and therefore a specific flow path through the economy. The first recipient of the new supply of money is in the convenient position of being able to spend extra dollars before prices have increased. But whoever is last in line receives his share of new dollars after prices have increased.”

Investopedia also described the Cantillon Effect, and ‘Biflation’:

“Biflation is a specific type of Cantillon effect. It happens when during a period of debt deflation (and resulting recession) the central bank pumps money into the economy in an attempt to reinflate asset prices. However, despite the central bank’s efforts, the recipients of the newly created money use it to purchase commodities and related assets rather than to try and fight the ongoing deflationary trend in debt markets. The central bank’s effort to stimulate the can not only fail but instead, can result in a rise in the cost of living as prices of raw materials and consumer staples may rise, similar to the effects of stagflation.

In a depressed economy, demand for raw materials used to make things such as energy, clothing, and food will likely remain relatively high because they are deemed essential purchases by consumers. People will often continue to buy them regardless of prices rises, leaving consumers with less money for discretionary expenses.”

Certainly, right now in Canada, we can see that we have a disturbing combination of a weak economy, along with rising prices.

Meanwhile, as would be expected, the Banks are doing just fine:

In the past year, TD Bank stock is up 33.98%.

CIBC is up 33.78%.

Royal Bank is up 22.24%.

Scotia Bank is up 29%.

Bank of Montreal is up 44.12%.

None of that is a surprise.

The amount of money in the system has expanded massively, and where is it going to go first?

The banks.

Banks and top investors – understanding how inflation will devalue their money – quickly convert their money into assets.

After some time, that money flows throughout the system, but by then the largest impact is simply to crush the earning power of most Canadians.

And this is exactly what we have witnessed.

Inflation is 4.9% (that’s according the government, the real rate is likely much higher), meaning most Canadians are poorer in actual terms.

Inequality based on proximity to the Bank of Canada, rather than productivity

The inflation we are seeing will drive further inequality, and will do so in a negative way.

While it is demonized, inequality in terms of income is not inherently a bad thing.

If the top 10% see their incomes rise (in real terms) by 200%, while the other 90% see an income rise of 100% (in real terms), everyone is better off and everyone is richer.

And, in societies where technological advancement and rising productivity are the main drivers of growth, rising income inequality isn’t usually a big concern given that benefits tend to be widespread.

But, when income gains at the top are based upon access to the firehose of fiat currency issued by the Bank of Canada, then inequality is a serious concern.

Worst of all, this surge of printed money is damaging to productivity and technological advancement, because it heavily distorts our economy and our perception of value.

Rather than a stable supply of sound money that generates accurate price signals, thus enabling the allocation of financial resources to the most efficient ends, an economy flooded with fiat currency generates massive inefficiencies and leads to a loss of true wealth.

Basically, those at the very top have access to new money first, and can use it before the debasement of the currency becomes fully noticed. By the time it is noticed, the majority of people are left paying higher prices, and trying to make ends meet with money that has been thoroughly stripped of value.

Of course, this has been going on for some time, particularly since the Gold Standard was abandoned in the US in 1971.

Canada went off the Gold Standard in 1929. However, from 1962-1970, the Canadian Dollar was pegged to the US Dollar. Since the US Dollar was still convertible into Gold – until 1971 – the Canadian Dollar thus retained some link to a tangible asset.

With the most powerful economy in the world having abandoned the link to Gold, the era of unfettered fiat currency had begun.

The results were profound, not in a good way.

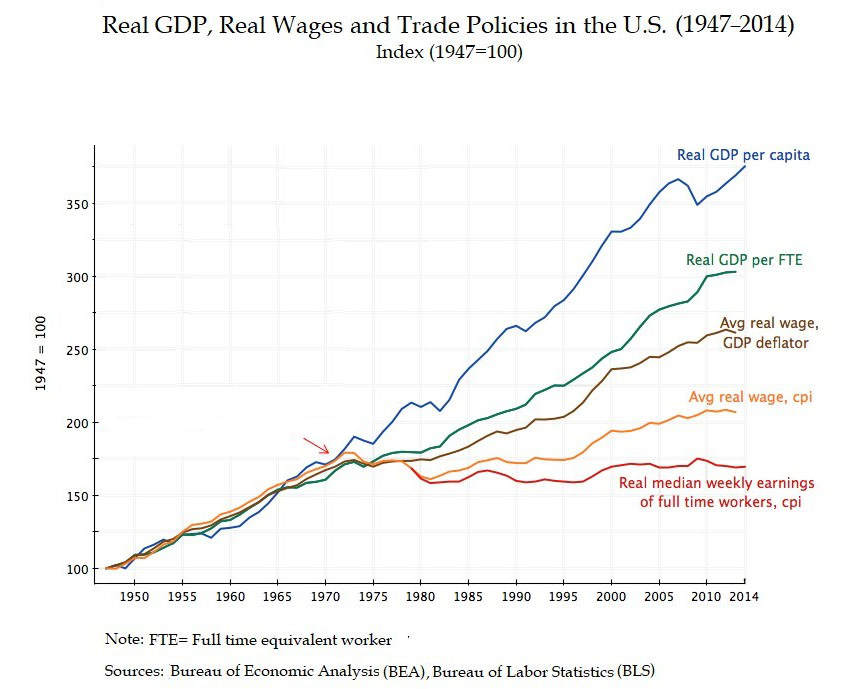

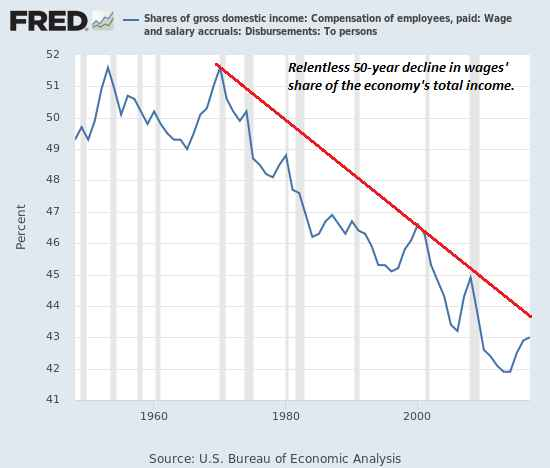

As noted by the website WTFhappenedin1971, many charts show the dramatic change:

While these are US figures, the numbers for Canada are quite similar.

And even without looking at the numbers, we can feel the truth of this.

Why is it harder now for families with two income earners to make ends meet than it was for families with one income earner in the past?

Why does it seem an entire generation is being locked out of the opportunities that were once taken for granted?

And why does it feel like so many people are worse off, despite a massive increase in the amount of ‘money’ flowing through the system, which should – if the statist money printers were correct – be making everyone richer?

With our money now completely unlinked from anything tangible, and with governments trying to fund radical expansions of the state and climate virtue-signaling with printed money, the Cantillon Effect continues to ramp up and do significant damage to our economy.

Fighting the ‘Cantillon Effect’

How can we push back against this?

On the individual level, an embrace of private, sound money such as Bitcoin can provide some protection, given that it is not controlled by governments, and has a limited supply.

Gold, Silver, and other commodities are also important, given that they are tangible and – while the supply can increase – do not have a supply that grows nearly as fast as the rampant expansion of the money supply.

Politically, it is important for Sound Money and limited government to become the core of our monetary and fiscal policies. That will require a concerted pushback against the current money-printing, heavy-spending, big-government consensus, which means persuading a growing number of Canadians to see the truth of why Sound Money is so important if we are to restore true prosperity and financial freedom in this country.

Spencer Fernando

***

You can support Spencer Fernando’s writing by making a contribution through PayPal, or directly through Stripe below.

[simpay id=”28904″]