Just like debt, higher prices are not a problem if income gains are keeping pace. But in Canada, wage growth has been trailing inflation for quite a while, and the purchasing power of Canadians is being eroded as a result.

As much as they claim otherwise, governments often love inflation.

While prolonged and extreme inflation can cause severe social distress, inflation is often tough to pin directly on governments.

People see inflation on the store shelves, making it easy to blame companies.

Inflation is often accompanies by ‘rising’ wages, with companies having to keep raising compensation so workers can somewhat keep up with the rising cost-of-living.

In theory, inflation isn’t necessarily bad.

If inflation was caused by a tremendous amount of investment flowing into a country and/or a technological advancement that led to a surge in productivity and higher value-added production, higher and higher wages could make increased prices affordable.

It’s the same with debt.

If Canada has a total government debt of $5 trillion in the year 2150, but our overall GDP is $15 trillion, that doubt would represent just one third of our GDP, and wouldn’t be a huge problem. It’s not the raw number that matters, it’s the relation of that number to the overall size of the economy.

But when debt growth outstrips GDP growth, or when wages can’t keep up with inflation, that’s when there is a problem.

And in Canada, wage growth has been lagging inflation for quite a while:

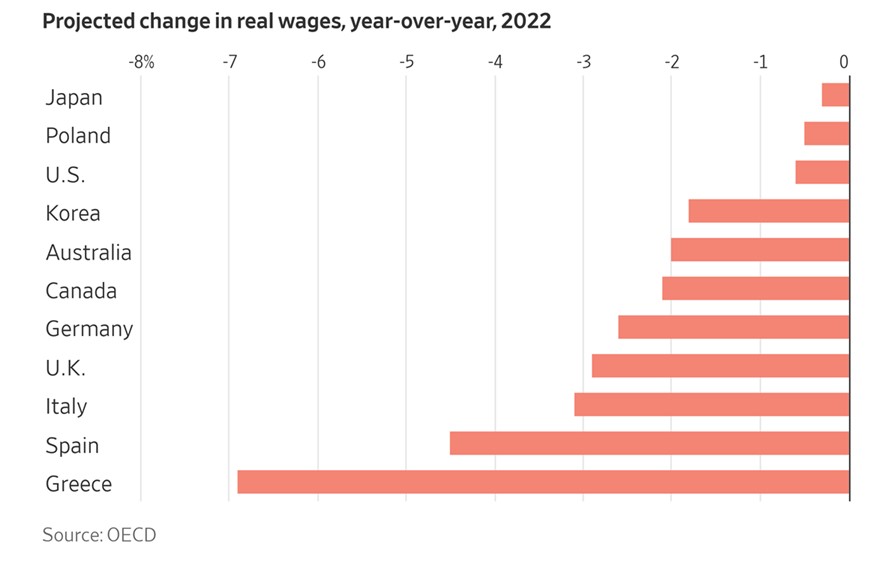

While on wages, this @OECD chart (via the @WSJ) illustrates the erosion in real earnings in 2022 as inflation surged.#economy #jobs #labor #employment #wages #inflation pic.twitter.com/HX0xL4o2oc

— Mohamed A. El-Erian (@elerianm) February 21, 2023

This is an important chart for a few reasons.

First, many Liberal politicians have crowed about Canada’s inflation rate by comparing it to the United States – where inflation is higher.

However, as you can see above, wages in the US have done a better job keeping up with inflation, meaning that even though Americans have lost purchasing power, that loss hasn’t been as significant in Canada.

Another reason the chart is important is that it shows why Canadians are fully justified in saying it already feels the economy is in a recession, despite Canada not officially being in one.

While a recession is defined as two consecutive quarters of negative growth, Canadians have been experiencing negative growth in their purchasing power for over a year.

Thus, while the raw numbers in terms of income may not have fallen, incomes have fallen in relation to prices.

What is also fascinating – and not in a good way – is to that Canadians lost purchasing power at a rate closer to Germany than the United States. That is quite surprising, since Germany has been experiencing significant challenges in rapidly moving away from a dependence on Russian energy sources – which has put significant inflationary pressure on their economy.

Canada – with our abundant energy reserves – should be doing far better than Germany.

But this just goes to show the importance of government policy.

With a government determined to artificially push up the cost of living through carbon tax hikes and anti-energy sector policies, Canadians are watching our earnings be eroded month after month.

Spencer Fernando